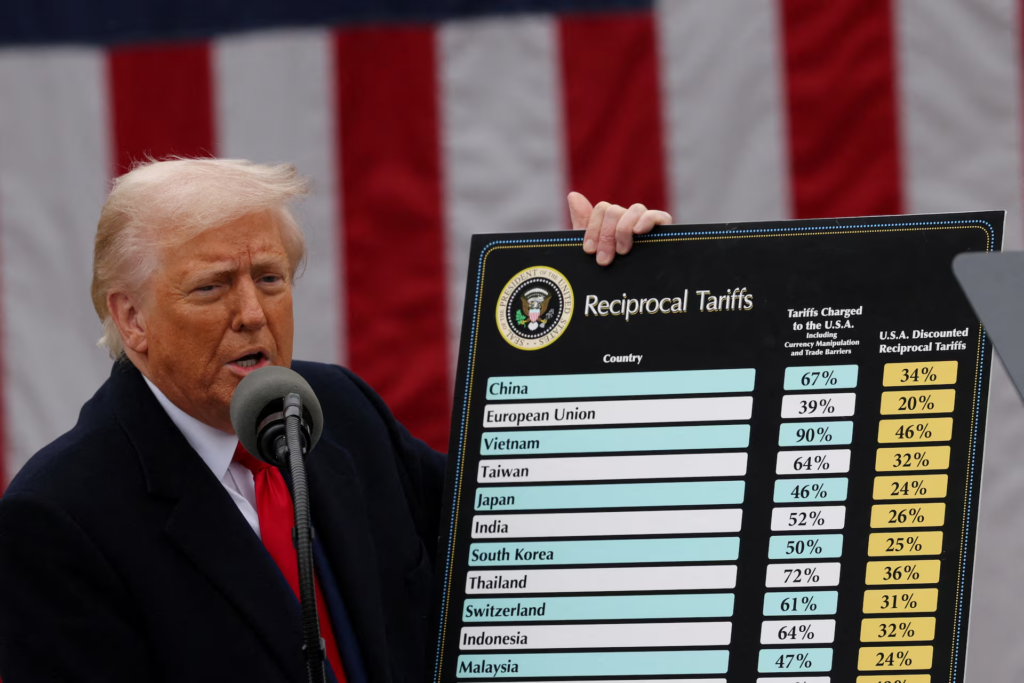

How Tariff Revenue Could Fund the Dividend

The administration claims that tariffs on imported goods, particularly from China, have generated historically high revenues, potentially funding the dividend. Trump has suggested “trillions of dollars” collected, although Treasury data reports about $90 billion in tariffs by late 2025—far below the $600 billion estimated cost to pay $2,000 to all eligible Americans. This funding gap has prompted economists to question whether the plan is realistic.

Distribution Options

Treasury Secretary Scott Bessent explained that the $2,000 payout may not be a direct check. Options include enhanced tax refunds, with Americans receiving $1,000–$2,000 via IRS processing; withholding adjustments, lowering taxes on wages, tips, overtime, or Social Security contributions to increase take-home pay; and expanded deductions, including mortgage interest, auto loans, or other eligible expenses. A hybrid approach combining these methods is most likely, allowing flexibility if tariff revenue falls short or legal rulings interfere.

Legal Challenges

Using tariff revenue to fund personal dividends may face legal scrutiny. Potential issues include Supreme Court review, where negative rulings could block use of tariff funds; Congressional oversight, as lawmakers may challenge funding allocations; and national security justification, with courts potentially questioning whether tariffs meant for national security can finance individual payments. These uncertainties make the plan politically and legally sensitive.

Economic and Inflation Considerations

Injecting $2,000 per person into the economy could boost consumer spending on groceries, bills, and discretionary purchases; increase take-home pay for low- and middle-income households; and risk inflation if spending surges too quickly, especially in sectors already under pressure. Treasury officials encourage Americans to save rather than spend immediately to help stabilize the economy.

Political Context

The dividend is closely tied to the 2026 midterms, targeting middle-income households for financial relief ahead of elections. Critics argue it’s a political move rather than a purely economic strategy, while supporters emphasize tariff success, domestic investment, and job creation.

Contingency Scenarios

Given uncertainties, the administration could issue partial payments, e.g., $1,000 instead of $2,000; focus on means-tested or targeted distributions for households most in need; or delay payments until late 2026 or early 2027, ensuring compliance with legal and fiscal constraints.

Key Takeaways

If implemented, the $2,000 dividend could provide short-term financial relief for millions of Americans, inject hundreds of billions into the economy, stimulate consumer activity, face legal, fiscal, and inflationary challenges, and influence political sentiment ahead of the midterms.

Bottom Line: The $2,000 tariff dividend is an ambitious, high-profile proposal that combines economics, trade policy, and politics. While millions may benefit, funding gaps, legal hurdles, and inflation risks make the plan uncertain.

Stay informed: Keep an eye on IRS updates, tax withholding changes, and official Treasury announcements to see how this plan could affect your wallet in 2026.

What do you think—will Americans really see a $2,000 tariff dividend? Share your thoughts below and join the conversation on how this could impact household budgets!